(610) 918-9698

(610) 918-9698

When evaluating homeowners’ insurance carriers, one of the most critical factors is how well they handle property damage claims—including water, fire, storm, and theft losses. The two key metrics homeowners care about are:

fairness, speed, communication, and transparency.

whether insurers pay full and fair settlements without unnecessary disputes.

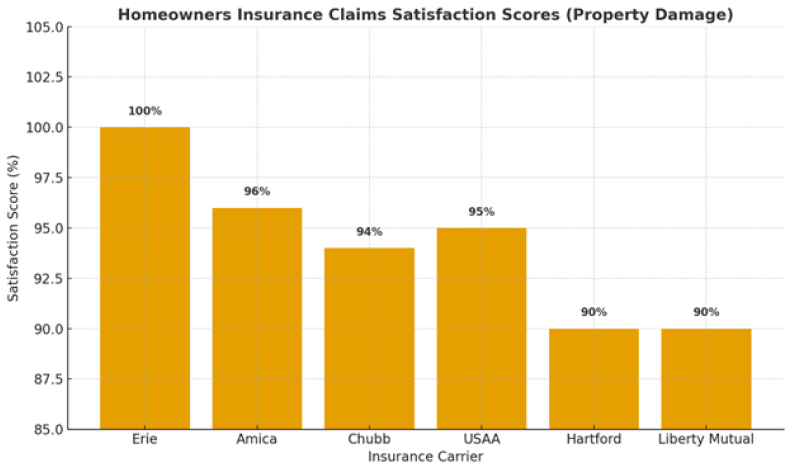

Independent studies from J.D. Power, Insurance.com, Consumer Reports, and NAIC complaint data provide insight into which insurers consistently deliver.

| Carrier | Claims Handling | Payout Experience | Best Fit |

|---|---|---|---|

| Chubb | Excellent (Top J.D. Power) | Strong replacement cost settlements | High-value homes |

| Erie | Excellent (100% satisfaction) | Generous payouts, fast processing | Mid-Atlantic / Midwest homeowners |

| Amica | Excellent (96% satisfaction) | Transparent, quick funds release | Families seeking service |

| USAA | Excellent (top-tier) | Consistent, fast payouts | Military members/veterans |

| Auto-Owners | Strong (low complaints) | Smooth settlements | Regional markets |

| Country Financial | Strong (low complaints) | Fair payouts | Rural/suburban |

| Hartford / Liberty | Good (90% satisfaction) | Solid but can be slower | Nationwide homeowners |

Chubb, Erie, and Amica lead in both claims handling and payout satisfaction.

USAA is consistently a top choice but limited to military families.

Regional insurers (Auto-Owners, Country Financial, Erie) often outperform big nationals in fairness and service.

Documentation is critical: even with the best insurers, keeping thorough records speeds up claims.

Surveys and rankings show Chubb, Erie, and Amica consistently provide the best payout experiences, with fewer disputes and higher satisfaction scores.

If needed, consult a licensed public adjuster or attorney.